After reading the first chapter of Psychology of Money, I flash backed on the event of my life that shaped the way I see money today.

Questions and attempted answers I had with myself.

Why do I keep track of my expense and income?

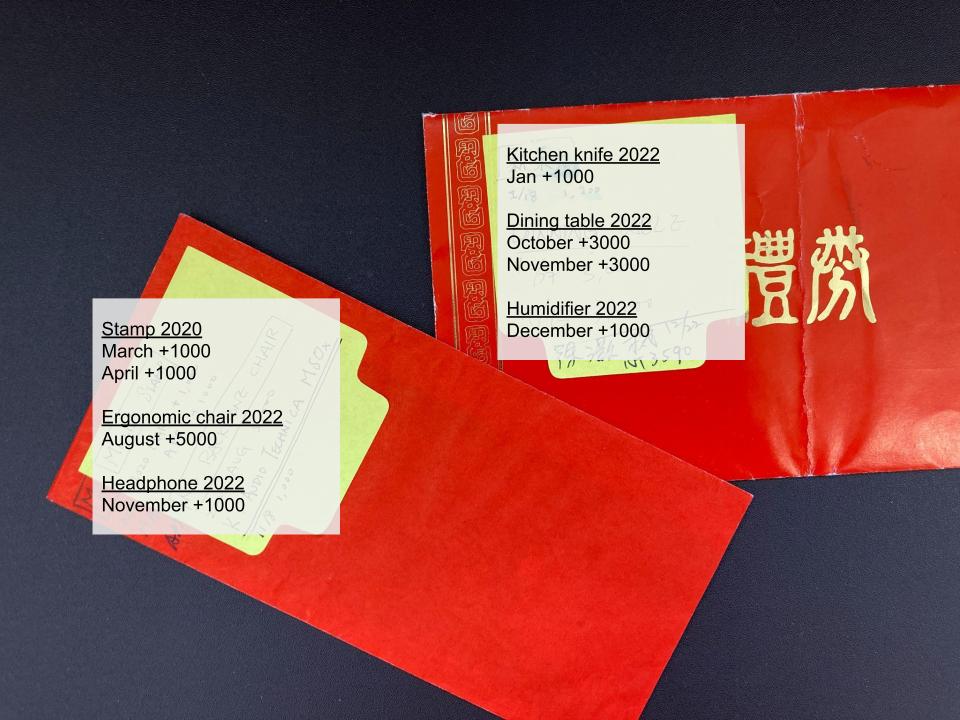

I started to receive allowance since the second grade, but my mom has a rule to play by. Before I knew how multiplication works, mom would ask me to list down all the date and the amount that I receive allowance, then add it up, have it checked by her (making sure addition weren’t wrong) before I receive the money. It looks something like this.

May 1, Bht$1

May 2, Bht$1

May 3, Bht$1

……

Total Bht$30

This tradition continued to 12th grade. By the time I entered college, I have been budgeting for a decade. This stuck with me ever since, from analog notebook to excel file to google sheet, from being single to a father.

Why does it take me forever time to make a purchase decision?

There’s a formula that my mom used to adjust my allowance. Bht$2 per day in second grade, Bht$3 per day in third grade, all the way until 11th grade when it flattened at Bht$20 per day. There’s an additional Bht$1000 for Lunar New Year and birthday. So even when I max out, it’d Bht$9300 a year and that’s all the money I have for going out with friends. A set of McDonald’s is 15% of the monthly budget, a taxi ride is 10%, so I need to save for months for a purchase.

Some purchase turned out to be a bad decision and I think that shaped followed me until this day. I remember saving $5000 in middle school to get a branded basketball shoes. I spent $3500 on a pair of NIKE, just to find out in the week after, that the shoes gain traction on the outdoor court I play in.

Why am I lazy, passive, and risk aversive when it comes to investing?

A good thing about budgeting for 2 decades is precise understanding and forecast for my expense. I rarely overspend my salary so there’s no urgency to make big money since I don’t ran out of them. Consequently, there’s really no urgency to get rich through risky investments.