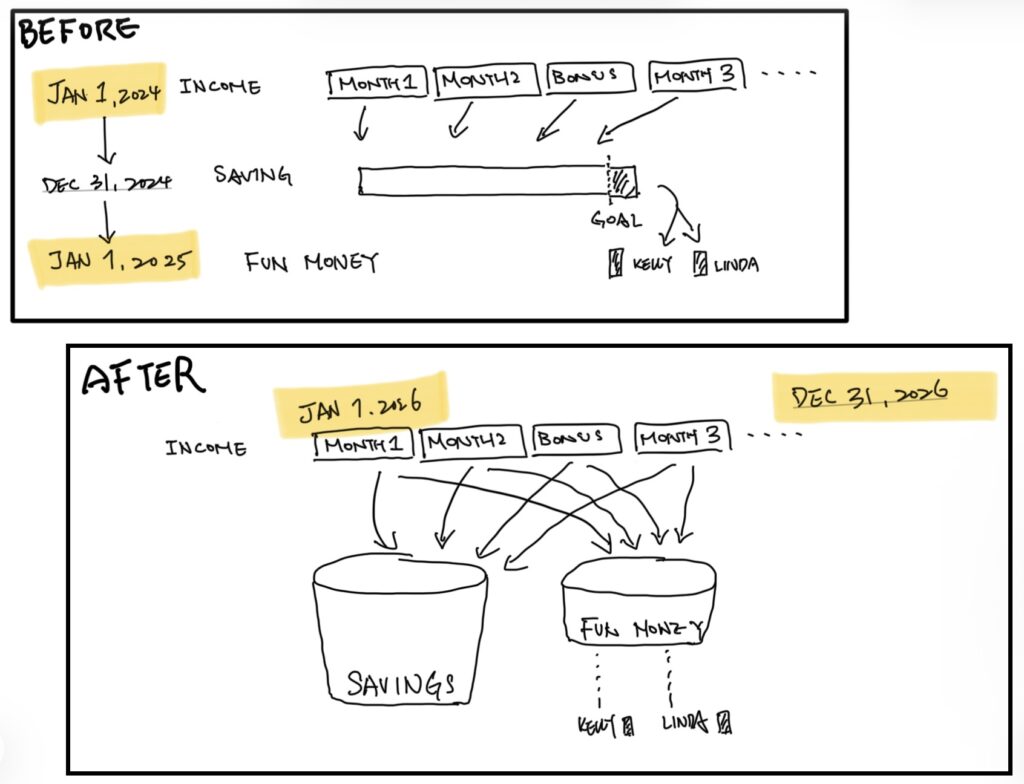

I decided to change the way to allocate fun money, from once a year to once a month.

- Original: split the difference after hitting the annual savings goal.

- New: allocate 5% of each regular income cycle and 50% – 60% of irregular income cycle.

Problem of fun money with “leftover” from annual savings:

- Unable to forecast how much will be received, no clear goal.

- Long wait time, easily side tracked by impulsive spending

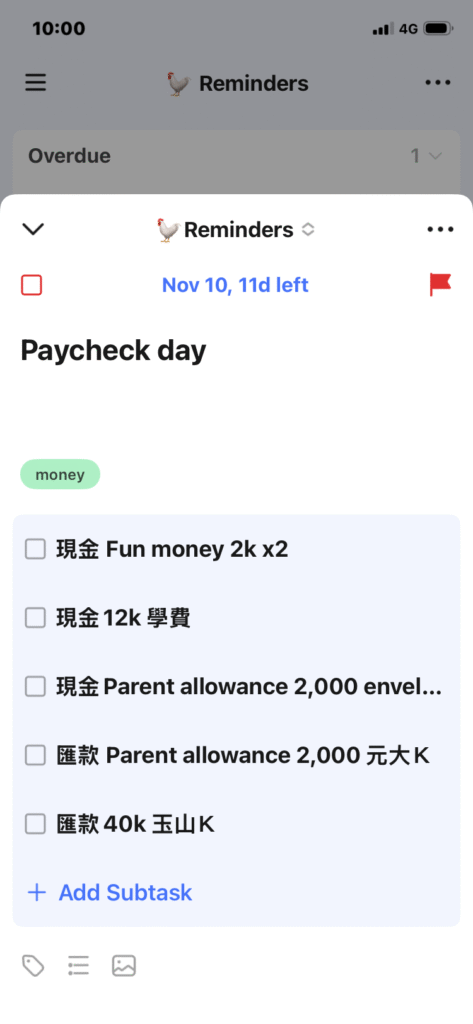

With allocating in each income cycle, the purpose is to act as a reminder to refocus whatever the purchase is. There’s a goal to save towards to and cycles to evaluate the expense.

Comments

One response to “Fun money (update)”

[…] Fun money gave some of that that back: having a thing or service to want and the progression to reach that. The result feels happy, the progression feels happy, and the anticipation feels happy. […]